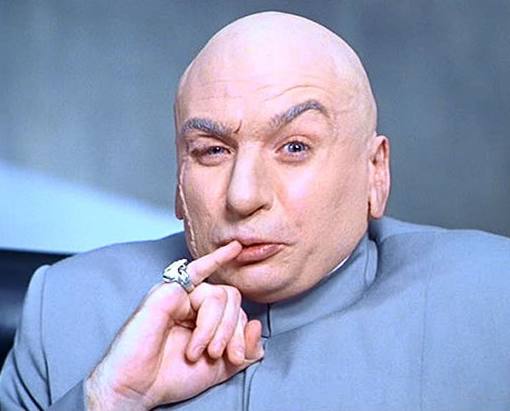

What Could Go Wrong?

They’ve already blown through billions upon billions, so let’s give Greece One Trillion Dollars

BRUSSELS (Reuters) – European central banks began buying euro zone government bonds under a $1 trillion global emergency rescue package agreed on Monday, sending the euro and European stocks and bonds surging on relieved markets.

The “shock and awe” plan — the biggest since G20 leaders threw money at the global economy following the collapse of Lehman Brothers in 2008 — triggered a global stock market rally after panic selling last week.

But it left longer-term questions about whether Europe’s weakest economies can manage their debt and how the European Union can develop more coherent economic and fiscal policies to underpin the single currency.

Gee, “questions”? Ya think? It’s not like these ministers reached into their piggy banks and pulled out their rainy day savings here; this money is being both printed, i.e. inflated, and borrowed from the Chinese, so these geniuses are leading us once again farther down the Keynesian Yellow Brick Road of “Inflate Your Way To Joy,” and pushing even more massive debt onto the next generation which they hope to cheapen by massive devaluation of the currency. It’s their only way out.